*

Gostei muito do perfil do Alan Greenspan -- The Fountainhead: https://www.newyorker.com/magazine/2000/04/24/the-fountainhead. Algumas passagens interessantes:

"It was the beginning of the bebop era. Jazz orchestras, featuring virtuosos like Dizzy Gillespie, were starting to emerge; and some of the old swing bands were forced to update themselves. One such outfit was the Henry Jerome Band, which played regularly at the Childs restaurant in the Paramount Theatre building, in Times Square. The band's manager, who also played in its horn section, was a young law student named Leonard Garment—the same Leonard Garment who went on to become President Nixon's counsel during Watergate. Garment still recalls the day when Alan Greenspan showed up at the Paramount. "He had exactly the same face, a slightly ironic, self-measuring smile, very interior-oriented," Garment told me a few weeks ago. "I played jazz tenor saxophone. Alan came into the band and played the other tenor saxophone, and he also played the clarinet and the flute. He was very good, very solid." Greenspan stayed with the band a year, during which time it alternated between touring and playing in New York. Even on the road, he was quiet and reserved. He put his interest in numbers to good use, assisting Henry Jerome, the bandleader, with the bookkeeping, and aiding some of his fellow-players with their income taxes, always a problem for itinerant musicians. In other areas, too, he helped to keep his colleagues in line. Above the Childs restaurant was a Walgreen drugstore that had a row of phone booths. Some of the musicians used the booths to smoke marijuana, and the drugstore manager would complain to Garment. When Garment didn't have time to retrieve the miscreants himself, he would dispatch his fellow tenor sax to do the job. "I'd say, 'Alan, could you get some of those guys down here? Tell them it's time to play and to stop smoking,' " Garment recalled."

"Greenspan likes to remind people that he has been observing the United States economy on a daily basis for more than half a century. In 1948, he took a job with the National Industrial Conference Board, a New York research group financed by big corporations. One of the businessmen who called for advice about the economy was William Townsend, a veteran Wall Street bond trader. Townsend was impressed by Greenspan, and in 1953 he asked him to join his firm as a partner. The offer came with an annual salary of around six thousand dollars, not much money even then, but it was a partnership, and Greenspan accepted. The decision made his career. During the next two decades, he built Townsend-Greenspan & Company into a thriving economics consultancy, with a roster of corporate clients that included Alcoa, U.S. Steel, and J. P. Morgan. (Townsend died in 1958, but his young partner left his name on the door.)"

"The opportunity for Greenspan to prove his independence arrived quickly. Between March, 1988, and March, 1989, the Fed raised short-term interest rates from six and a half per cent to almost ten per cent, to head off inflation. The resultant recession didn't start until August, 1990, and lasted less than a year, but as 1992 approached President Bush's economic advisers grew increasingly concerned that the Fed was not cutting interest rates quickly enough to insure a vigorous recovery. Nicholas Brady, the Treasury Secretary, was an old pal of Greenspan's from Wall Street, but that didn't prevent Brady from repeatedly calling for more interest-rate cuts. The friendship between Brady and Greenspan turned increasingly sour. At one point, Brady even cancelled his weekly lunches with the Fed chairman. After Bush's defeat, some Republicans blamed Greenspan for losing them the election. (Arguably, it was the second time he had cost the G.O.P. the White House.)"

*

Aliás, lembrei dessa também: UM ÍNDIO DE MANAUS NO NEW YORK TIMES -- https://piaui.folha.uol.com.br/materia/um-indio-de-manaus-no-new-york-times/

*

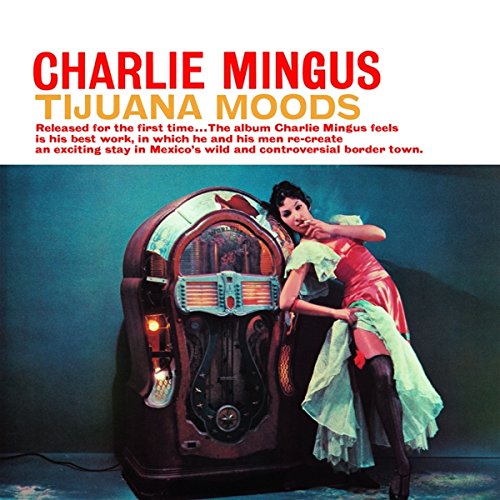

Escrevendo, estive ouvindo este:

Nenhum comentário:

Postar um comentário